Legal & Regulatory

- Home

- Legal & Regulatory

FrameDay Legal and Regulatory Information

FrameDay, as a platform that combines innovative forex trading and marketing strategies, operates in compliance with the highest legal and regulatory standards to ensure customer safety and satisfaction. We are committed to maintaining transparency, integrity, and security in all our operations.

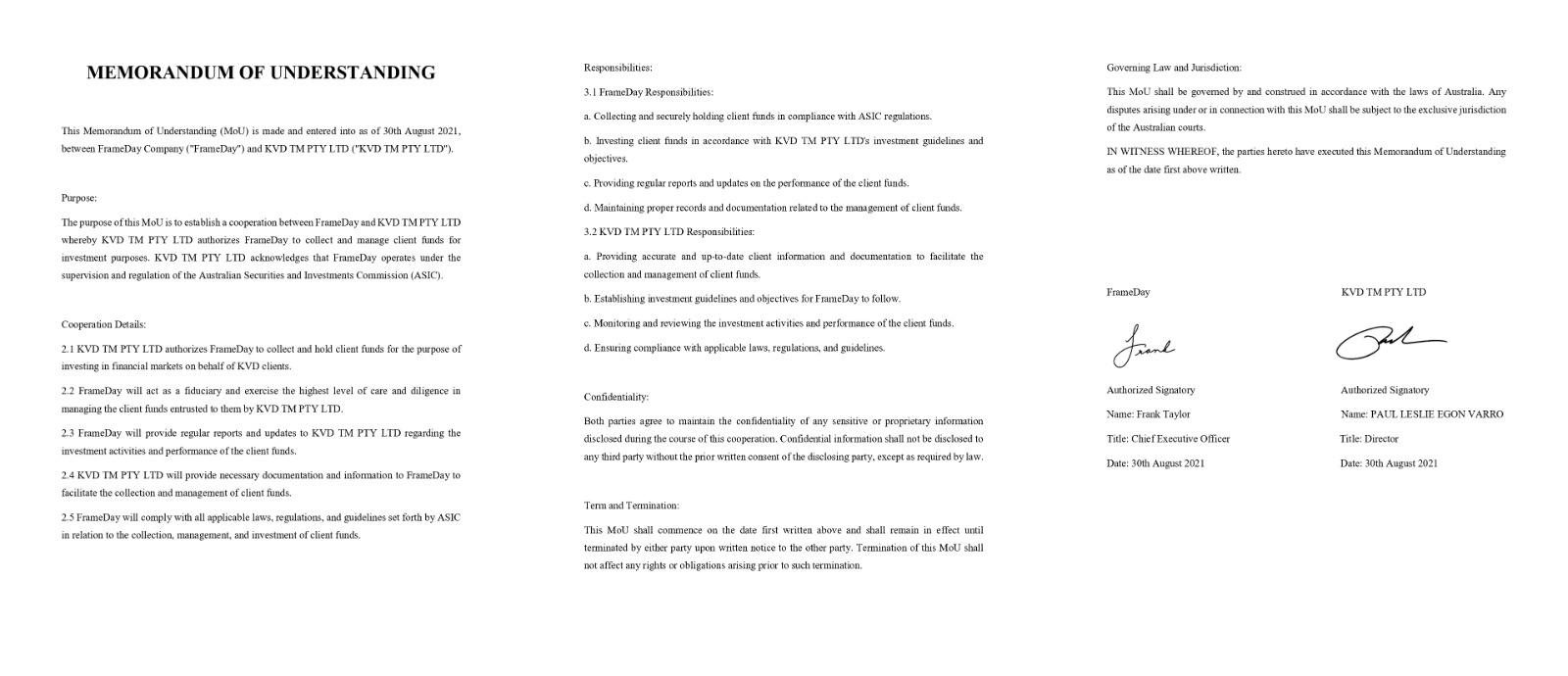

Collaboration with KVD TM PTY LTD

Our partnership with KVD TM PTY LTD, an esteemed asset management company based in Perth, Australia, with over eight years of service, further reinforces our commitment to secure trading. KVD is well-regarded for its credibility and for providing excellent forex services to high-end clients in Australia.

Under this collaboration, KVD handles the asset management aspect, enhancing the security of our client’s investments. Their robust risk management strategies, coupled with their proficiency in the forex market, ensure that our clients’ assets are managed and protected effectively.

Client Security

Client security is our top priority. We ensure that our customers’ funds are held in segregated accounts, separated from the company’s operational funds. This way, we can assure all our users that their funds are secure and cannot be used by the company for its operational expenses.

Legal Compliance

FrameDay adheres strictly to regulatory guidelines. As part of our commitment to legal compliance, we follow rigorous processes for customer identification, verification, and security. Our policies are designed to prevent any illegal activities, such as money laundering and fraud.

We also maintain a robust data protection policy to safeguard customer information. We use advanced encryption technology to protect data transmission and storage, ensuring that your personal and financial information remains confidential and secure.

By maintaining these standards and following stringent legal and regulatory guidelines, FrameDay ensures a secure and trustworthy environment for our users. We are dedicated to providing a seamless, safe, and profitable forex trading experience for all our clients.

Please note that forex trading involves significant risk, and it may not be suitable for all investors. It’s essential to understand the risks involved and consider your risk tolerance before engaging in forex trading.

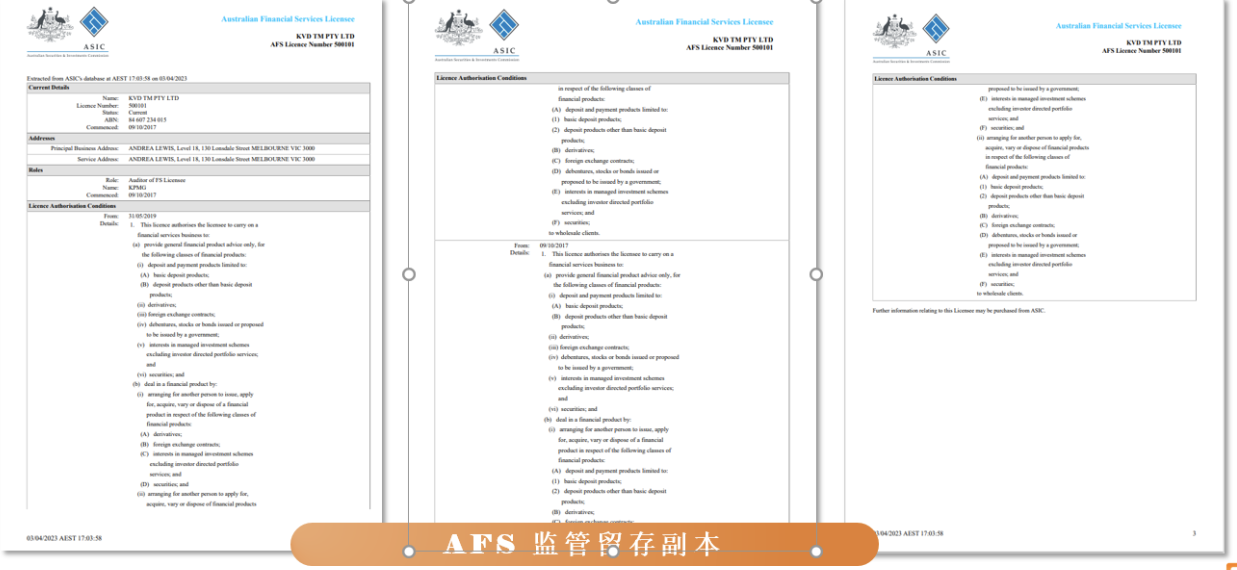

ASIC Certification

The Australian Securities and Investment Commission ASIC was established under the securities investment board act (ASIC act) in 2001. The agency is an independent government department and independently monitors the company, its investment practices, its financial products and services. The Australian Securities and Investment Commission is the regulator of Australia’s banks, securities and foreign exchange retailers. With the 2001 Australia “Securities Investment Commission Act” the introduction of ASIC from the retail foreign exchange market into the daily supervision, supervision together with banks, securities, insurance and other financial industry, has become an important part of the Australian national financial system.

The basic function of ASIC lies in maintaining the integrity of the market and protecting the rights and interests of consumers. The integrity of the market is to prevent market manipulation, fraud and unfair competition, protection of market participants from financial fraud and other unfair practices, so as to enhance investor confidence in financial markets, to maintain the stability of consumer protection in financial markets is reflected in the full and timely market information disclosure, securities company, and ensure the market the option of honesty and justice, ensure that small investors can obtain sufficient and accurate information when the interests of investors by injustice suffered losses, compensation can be obtained through proper channels.

Australian financial services and markets, ASIC Australia is an independent federal agency, the federal government approval, according to the provisions of the 2001 parliament approved Australia “Securities Investment Commission Act”, the independent travel institutions according to law on financial supervision in Australia, the financial system financial institutions and professional personnel functions.

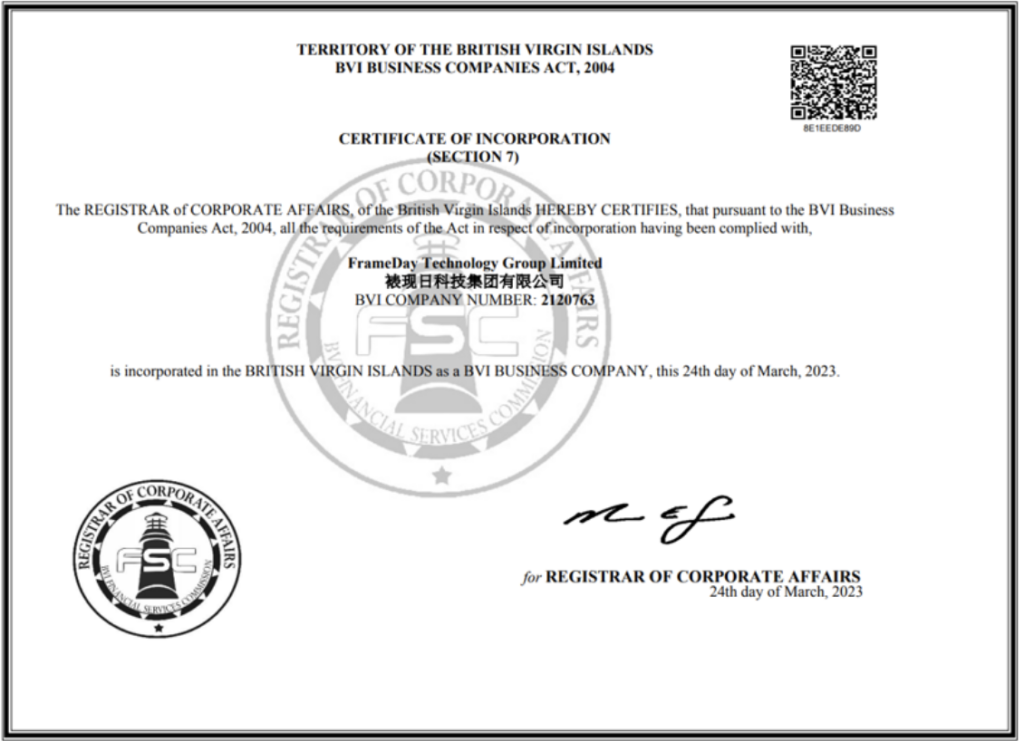

Company Register Cert

FrameDay Technology Group Limited (BVI Company Registration)